Fascination About Transaction Advisory Services

Table of ContentsThe Transaction Advisory Services DiariesMore About Transaction Advisory ServicesTransaction Advisory Services Fundamentals ExplainedThe Ultimate Guide To Transaction Advisory ServicesTransaction Advisory Services - Questions

This step makes certain business looks its best to possible purchasers. Obtaining business's value right is important for a successful sale. Advisors utilize various methods, like affordable cash money circulation (DCF) analysis, comparing to comparable companies, and current purchases, to figure out the reasonable market value. This aids set a reasonable rate and bargain properly with future buyers.Purchase consultants action in to help by getting all the needed info arranged, responding to questions from buyers, and preparing sees to the organization's place. Deal experts utilize their knowledge to aid organization owners handle tough settlements, satisfy customer assumptions, and framework offers that match the owner's goals.

Fulfilling legal rules is critical in any business sale. They assist organization owners in intending for their next steps, whether it's retirement, starting a brand-new endeavor, or managing their newly found wealth.

Transaction advisors bring a wide range of experience and understanding, ensuring that every facet of the sale is dealt with professionally. Via critical preparation, assessment, and settlement, TAS helps company owner attain the highest feasible list price. By making certain legal and regulative conformity and handling due persistance together with various other deal staff member, transaction experts lessen prospective threats and liabilities.

What Does Transaction Advisory Services Mean?

By comparison, Big 4 TS groups: Service (e.g., when a possible customer is conducting due persistance, or when an offer is shutting and the buyer requires to integrate the business and re-value the seller's Annual report). Are with fees that are not linked to the bargain closing effectively. Earn costs per engagement somewhere in the, which is much less than what investment banks gain even on "small deals" (however the collection likelihood is also much greater).

The interview inquiries are very similar to financial investment financial interview inquiries, but they'll concentrate much more on audit and valuation and much less on subjects like LBO modeling. Anticipate questions concerning what the Adjustment in Working Capital means, EBIT vs. EBITDA vs. Net Income, and "accounting professional just" topics like trial equilibriums and exactly how to walk via events utilizing debits and credit ratings as opposed to monetary declaration adjustments.

Not known Factual Statements About Transaction Advisory Services

Professionals in the TS/ FDD groups might also interview monitoring regarding every little thing over, and they'll compose a detailed record with their findings at the end of the process.

, and the general form looks like this: The entry-level role, where you do a whole lot of data and economic analysis (2 years for a promotion from right here). The following degree up; comparable job, however you obtain the even more fascinating bits (3 years for a promo).

Specifically, it's challenging to get advertised beyond the Supervisor degree since couple of people leave the job at that stage, and you need to begin revealing evidence of your ability to produce revenue to breakthrough. Let's start with the hours and way of life since those are less complicated to describe:. There are periodic late evenings and weekend job, but absolutely nothing like the frantic nature of investment financial.

There are cost-of-living adjustments, so anticipate lower compensation if you're in a cheaper place outside significant financial facilities. For all placements other than Companion, the base pay comprises the bulk of the total compensation; the year-end benefit could be a max of 30% of your base pay. Usually, the most effective means to enhance your earnings Web Site is to change to a various firm and bargain for a greater income and bonus offer

3 Simple Techniques For Transaction Advisory Services

At this stage, you must simply stay and make a run for a Partner-level function. If you want to leave, possibly move to a client and perform their valuations and due persistance in-house.

The major issue is that due to the fact that: You typically need to join an additional Huge 4 team, such as audit, and work there for a few years and then relocate into TS, work there for a couple of years and then move into IB. And there's still no assurance of winning this IB duty due to the fact that it relies on your region, clients, and the working directory with market at the time.

Longer-term, there is likewise some risk of and because reviewing a firm's historic financial information is not specifically rocket science. Yes, humans will certainly constantly need to be included, but with advanced innovation, lower head counts could possibly sustain client engagements. That stated, the Purchase Providers group beats audit in terms of pay, work, and departure possibilities.

If you liked this write-up, you may be interested in reading.

A Biased View of Transaction Advisory Services

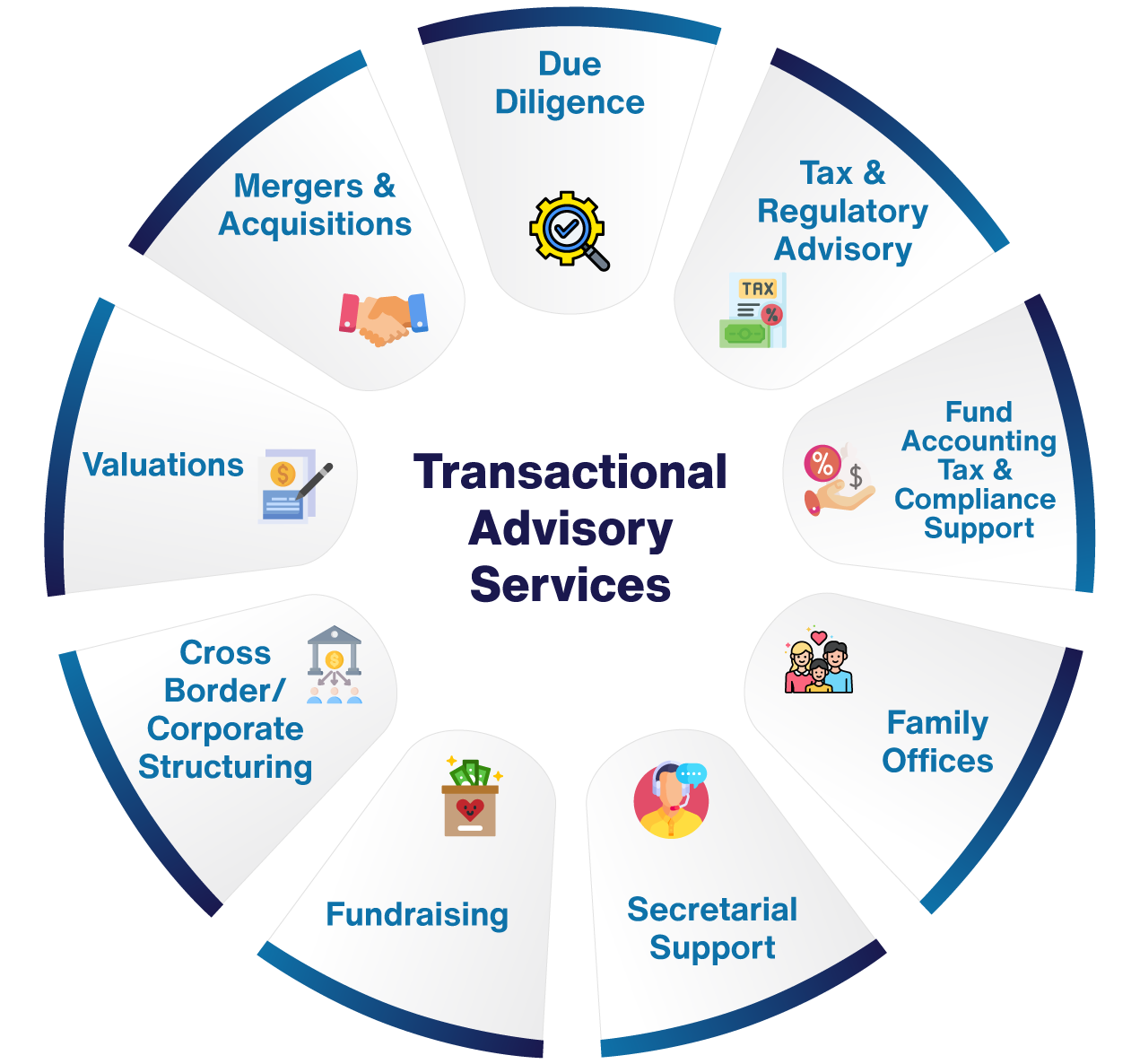

Develop sophisticated economic frameworks that aid in figuring out the actual market price of a company. Offer advisory job in relation to organization assessment to help in bargaining and rates structures. Describe the most appropriate type of the deal and the kind of consideration to employ (cash money, supply, make out, and others).

Establish action plans for risk and exposure that have been recognized. Execute combination preparation to figure out the process, system, and organizational adjustments that might be needed after the deal. Make mathematical estimates of combination prices and benefits to examine the financial reasoning of integration. Set standards for incorporating departments, innovations, and business processes.

Identify potential reductions by that site reducing DPO, DIO, and DSO. Evaluate the prospective client base, sector verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides important insights into the functioning of the firm to be obtained worrying threat evaluation and worth production. Identify short-term modifications to funds, financial institutions, and systems.